Fraud and Your Small Business

Business fraud is a scary term, and nobody thinks it can happen to them. Business fraud can be committed by employees, or can be committed against the business as a whole. In either case, this is a serious issue and…

Business fraud is a scary term, and nobody thinks it can happen to them. Business fraud can be committed by employees, or can be committed against the business as a whole. In either case, this is a serious issue and…

Many business owners have the same question at one point in their careers – when do I incorporate? It is not as simple as “when you see profits” although we wish the decision was that easy. For-profit businesses can be…

There are tax savings strategies like medical, donations and childcare that everyone tends to know about. But what about those tax deductions that are less common and very useful? Below are a few tax credits that you might find useful…

It has been a long-term goal for our Managing Partner, Howard Wirch, FCPA, FCGA to expand Accent Chartered Professional Accountants into the Brandon Market. This year we are excited to announce that Howard’s goal has become a reality! Accent CPA…

Canada Revenue Agency (CRA) has recently updated its guidance on a number of several employment benefits, which turns out to be good news for employers and employees. One of the changes included is a new policy on fits and awards.…

When preparing your personal income tax return for 2022, there is a new tax that you should be aware of that may apply to you. The Underused Housing Tax is an annual 1% tax on the ownership of vacant or…

With personal tax season fast approaching, we often get asked the question – “What should I be claiming on my income taxes that I don’t know about?” The answer is not necessarily the same for everyone. It depends on their…

Since the calendar has turned to 2023, it’s hard to believe that tax season is just around the corner. Some of you might be wondering what’s new for filing your 2022 Income Tax return. Here are some of the changes…

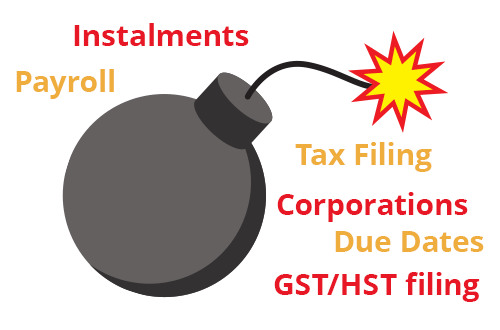

If you own a small business in Canada, there are several important deadlines from Canada Revenue Agency (CRA) that you should be aware of. Failure to meet these requirements can result in the penalties and interest assessed by CRA. Payroll…

With the calendar turning to 2023, it is a good time to consider tax planning. One of the most interest opportunities for tax planning is Immediate Expensing of Capital Property. The 2021 Federal Budget introduced new rules with respect on…